Why in news?

A recent report on urban financing for India is another case of a top down approach that is over dependent on technocentric solutions and capital-intensive technologies.

What is the case of urbanization in India?

- Urbanization - Urbanization is the increase in the proportion of people living in towns and cities.

- Urbanization occurs because people move from rural areas to urban areas (towns and cities).

- Trend in India - In 2021, approximately a third of the total population in India lived in cities.

- Major causes of urbanization

- Industrialization

- Commercialization

- Better services in urban areas

- High standard of living

- Ample employment opportunities

- Modernization

- Rural-urban transformation

What are the findings of the World Bank report?

- Focus area - The World Bank report focuses on private investments ameliorating urban problems.

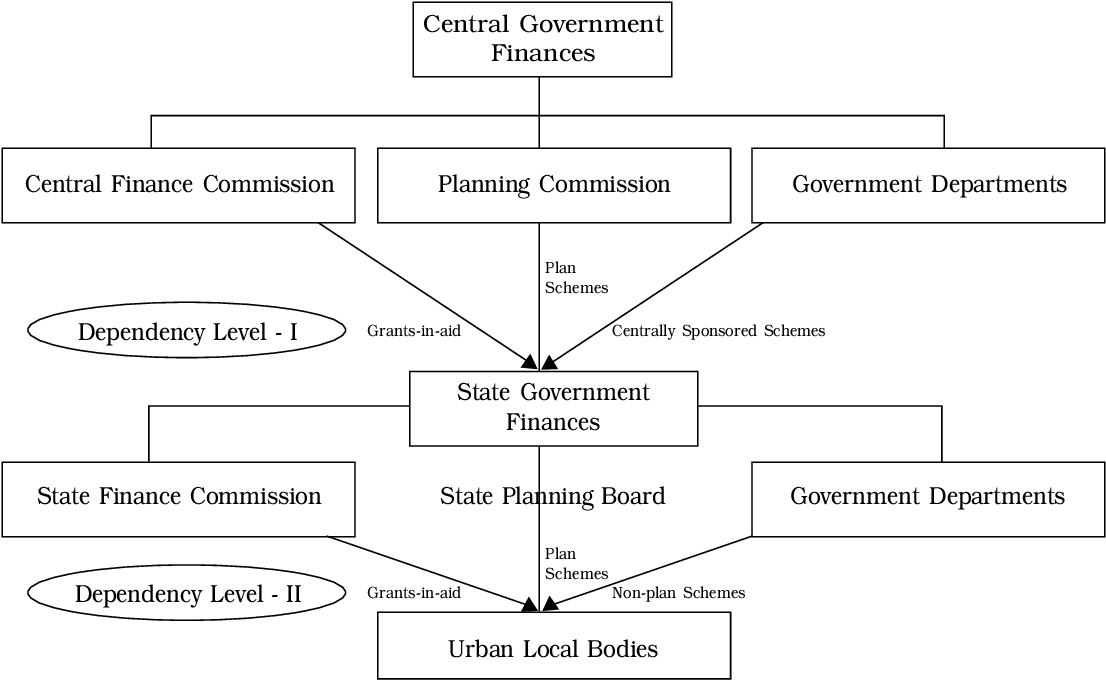

- Source of urban finance - After three decades of reforms, urban finance predominantly comes from the government.

- Of the finances needed to fund urban capital expenditures, 48%, 24% and 15% are derived from the central, State, and city governments, respectively.

- Public-private partnership projects contribute 3%.

- Government revenue - The report points out that nearly 85% of government revenue is from the cities.

- WB estimates - The World Bank (WB) estimates that nearly Rs 70 lakh crore would be needed for investment in urban India to meet the growing demands of the population.

- Suggestion - The solutions suggested include improving the fiscal base and creditworthiness of the Indian cities by enhancing the tax base.

What are the issues?

- Demand and supply gap - Matching the gap between demand and supply is a major challenge.

- The flagship programmes such as the Smart City mission, the Atal Mission for Rejuvenation and Urban Transformation (AMRUT), the Pradhan Mantri Awas Yojana (PMAY), etc., are not more than Rs. 2 lakh crore.

- Skepticism in enhancing the tax base - Meeting the rising demands of urban infrastructure in the cities even by enhancing the tax base remains skeptical.

- Top to bottom approach - The basic problem with this report is that it is made using a top to bottom approach, with too much of a focus on technocentric solutions.

What is the need of the hour?

- Plans must be made from below by engaging with the people and identifying their needs.

- The city governments and the people need to be empowered.

- The recommendations of the national task force that reviewed the 74th Constitutional Amendment, chaired by K.C. Sivaramakrishnan can be implanted. It includes

- Empowering the people

- Transferring subjects to the city governments

- 10% of the income-tax collected from cities be given back to them

- Ensuring that this corpus fund was utilised only for infrastructure building

- Regular elections should be held in cities and there must be empowerment through the transferring of the three Fs: finances, functions, and functionaries.

The 74th Amendment Act of 1992 provides a basic framework of decentralisation of powers and authorities to the Municipal bodies at different levels.

Quick facts

- The Smart City mission - To promote cities that provide core infrastructure, clean and sustainable environment and a decent quality of life to their citizens through smart solutions

- The Atal Mission for Rejuvenation and Urban Transformation (AMRUT) – To provide basic services (e.g. water supply, sewerage, urban transport) to households and build amenities in cities to improve the quality of life for all

- The Pradhan Mantri Awas Yojana (PMAY) - To provide affordable housing to the urban poor by the year 2022

Reference

Post a Comment

We welcome relevant and respectful comments. Off-topic or spam comments may be removed.